It is important for employees to understand the mechanism of their company’s pay stub. It includes details about one’s earning and maintains a record of the wages.

A Real pay stub assists in understanding the paychecks and provides all the specifications regarding wages earned during your payment for the specific span and even your year-to-date payroll. It can be generated electronically or printed traditionally on paper. In some states, it is mandatory to disburse check stubs, whereas, in others, employees enjoy the liberty to ask for them.

Visit here if you are interested in getting accurate and dependable documents.

What value do pay stubs hold?

Both employers and employees are benefited from Pay stubs. It aids in maintaining a record of the wages. Sometimes these tax deductions might be confusing, and an employee might be unable to understand the cuttings and additions. In these cases, all an employee has to do is review his pay stub! Because of their extreme transparency, no employee has to suffer from comprehending the finances and accounting.

Employers can use check stubs to rule out the chance of discrepancies and pay fairly according to the work hours of the employees. A paystub can furnish employers with information utilized for record-keeping, as commanded by the Fair Labor Standards Act (FLSA). Albeit the FLSA has no check stub necessities, businesses should give information about their compensation under states’ laws.

What are the common abbreviations used in a real pay stub?

There are some essential abbreviations used in your paystub; it is vital to understand their significance. Some of them are:

YTD- Year To Date

FL- Family Leave

INS is an abbreviation of Insurance, while RET is the short form of retirement.

SSN refers to Social Security Number.

What information is included on a Paystub?

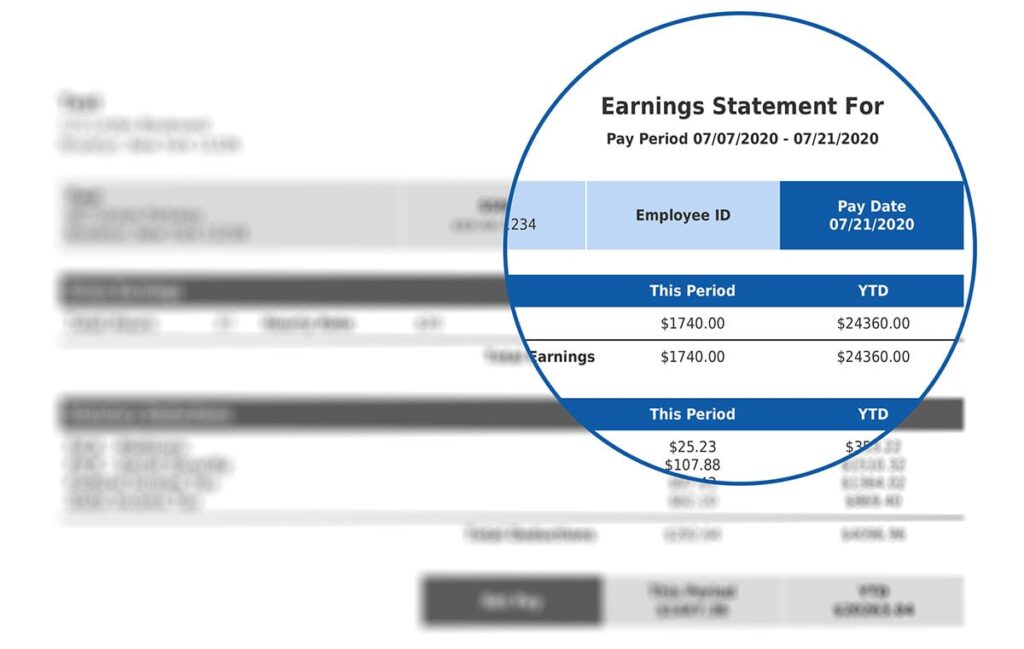

A Pay Stub includes personal information, federal and filing status (married or single), home address, and information about your specific job. It also shows the beginning and ending dates of the payroll vis-à-vis the actual date of payment.

It also gives a summary of before and after-tax deductions. It shows the amount, which is a portion of Employer Paid Benefits, but keep in mind these are not deducted from the earnings. Apart from this, numerous details can be incorporated into a Real Paystub so that it’s easier to keep track of the payments and deductions. Majorly, the items on the pay stub can be broadly categorized into:

- Gross wages

- Deductions and contributions

- Net wages

To get a better understanding, read the categories, which are explained in detail.

- Gross wages

Gross pay refers to the amount listed on your real paystub before deductions. Gross pay is either calculated on an hourly or a salary basis. It is entered in two sections; one section represents the present gross pay, and the other section shows the full year-to-date amount.

Hourly paid as well as salaried employees have their hourly wages listed on their pay stubs. Extra hours are also recorded. Include pay rate as well. You can calculate overtime pay by multiplying the overtime hours that you’ve worked by your overtime rate. It should be about twice the amount of your regular wages. Each type of hour should have its separate section on your pay stub.

Additional income such as bonuses, vacation pay, and other extra wages must be updated in your check stubs.

- Deductions and contributions

Gross pay is simply the total amount of money that a company has to pay to its employees. However, the chances of employees getting these amounts are less because companies often make certain deductions. The employee’s real pay stub has a track record of all the deductions the company might have made at any given time.

Apart from these deductions from an employee’s wage, we also have the taxes that a company pays on an employee’s wage, and these are clearly displayed on a real pay stub. Deductions on a real pay stub are divided into two categories, current deductions and year-to-date amount.

Tax deductions: Federal taxes are imposed on incomes and wages earned by employees, and these portions of the taxes usually go to the governments. Taxes such as payrolls are also included in an employee’s real pay stub; these tax deductions help pay for medicare and social security. State income taxes are location specific so if an employee falls in a state that imposes these state income taxes, there is no escaping it!

All the taxes on an employee’s real pay stub must be divided properly, and year-to-date and current pay period taxes must be adequately sectioned for clarity.

Deductions for welfare programs and benefits: The contributions you make for employer-sponsored welfare programs and benefits also appear in your paystub. 401ks and 403(b)s and other retirement plans, insurance as well as health and savings accounts are also listed in your paystub.

Employee withholdings: You may choose to contribute a part of your wages to community funds and college funds for your future. These contributions will show up on your paystub as well.

It is essential to keep track of all contributions, plans, and premiums on an employee’s pay stub to prevent mishaps and to ensure transparency and compensation for their labor.

- Net wages

Now, the income you see on paper is quite different from the income that employees get. The amount of money that these employees actually take home after inevitable federal taxes and a plethora of other deductions is known as the net wages. Thus your net wage is the sum that you receive from your employee at the termination of your pay period.

Conclusion

Companies are actively using pay stubs to rule out any chances of defaults. They help the employer to address all the inquiries that the workers might have unhesitatingly to guarantee them that the payroll processes are exact without fail. Check stubs also summarize working hours put in by the employees, which can further be used to understand workers’ level of efficiency.

A few things should be kept in mind while distributing pay stubs to avoid confusion and for better clarity. One should be crystal clear about the method being adopted by the payroll team to calculate the pay. There should be complete transparency regarding the employer-paid benefits to avoid any conflicts later. The companies should not fear to step into the world of technology and adopt the latest software and stay up to date. Apart from this, check stubs are very tricky to understand; it’s necessary to explain and help employees who are new to the concept.

Check stubs are a crucial part of an organization as it helps to build trust and employees feel worthy. It additionally saves you time by offering all the information they need upfront.