Knowing how, when, and where to invest can be very challenging for an average person.

Just ask any person who is frequently working in this world, and you will receive an answer that this is quite hard, no matter how much experience you have. This is why most people seek advice from experts like stockbrokers or financial advisors when they want to advance some of their money on a particular piece of business.

It needs to be said that there are a lot of people who market themselves as experts, but what they know and the skills they possess are surplus to requirements. Not only that, this opens a large space for a wide array of different frauds. Therefore, if you are interested in becoming a part of this world, you will need to be careful about the people you will consult.

All in all, finding a proper expert who can help you will not be as easy as many people believe.

Though investments are risky, there are times when the people you trust to invest on your behalf defraud you. What happens then? Can you get your money back? The answer is yes, but only in some cases. In most cases, you will not be able to get it back. However, you will need the help of a good investment lawyer from Wolper Law Firm to get your money back. It needs to be said that this is the most efficient way you can get a return.

There are several types of investment misconduct that are recognized by law. If a broker or financial advisor commits misconduct that falls under the fraud classes covered by the law, you should seek the services of an expert lawyer. Certainly, you will need to have some information before you are ready to make the first move. Here are some of the types of investment fraud in which you can recover your losses.

Breach of Fiduciary Duty

This is one of the most common types of misconduct. Your financial advisor is an investment professional with expert knowledge of investment markets. You trust in them, which means that they owe you a fiduciary duty when it comes to handling your money. In this case, these consultants will take an advantage of you, and use your money to their benefit. In most cases, to your loss.

A breach of their fiduciary duty means that they put their interest and the interest of their firm before yours. If your financial advisor also fails to monitor the changes in the market or take the right actions to protect your investment, they may be in breach of fiduciary duty. Of course, the ultimate result will not be to your advantage as you can presume.

Therefore, you will not get any of your money again.

Inadequate Supervision

If you use a brokerage firm to invest, you should be aware that they are required to put in place a system to supervise their brokers or financial representatives. If they fail to adequately do this, they should be held liable for the losses. Of course, you have delegated authority to some other party, who is responsible for handling your money.

Failure to supervise claims can result from failing to monitor the activities of the representatives or inadequate hiring processes. The’s of quality in this supervision, there’s nothing you can do about that. However, you can hold the party responsible and it is possible for you to get some of it back.

Unsuitable Investment Recommendations

Even though fiduciary duty does not apply to stockbrokers, they are required to take into account their client’s financial situations and needs recommending an investment. If they fail to meet the FINRA’s suitability standards, then the investor can choose to sue them and recover their money. Despite this is not comfortable, since you are about to face some loss, you will be able to get something out of it.

Unauthorized Trading

This is a very malicious form of investment fraud that a broker or advisor commits.

Unauthorized trading occurs when the advisor or broker makes trades without getting permission from you. It needs to be said that this is one of the commonest frauds.

Do not let your advisor convince you to accept your losses because investing is tricky. You can sue and recover your cash. But you need to be careful before choosing a particular trader who will be following all your inputs.

Misrepresentation by Omission

When you consult a financial advisor or broker, they should tell you all the facts about the investment you want to make. This is a requirement by the law. If they omit some details to trick you into investing, they can be held liable.

Once again, it is important to opt for an advisor that will provide you with some quality advice. Otherwise, you can lose some money, which you certainly don’t want to experience. Therefore, try to make the best decision possible.

Lack of Diversification

Putting all your money into a single investment is a huge risk. Your advisor should create a diversified portfolio for you. If they fail and you lose your money, you can make a claim against them.

The commonest way we can see this in this day and age is through the cryptocurrency market. By buying only one of these is a bad thing to do. Instead, you should choose two or more of them. That way, you will enhance the possibility of earning some money.

Selling Away

This misconduct occurs when a broker is not supervised by their firm. They can choose to act on their interest and sell away to get higher or more commissions. If you suspect that your broker is guilty of this fraud, you should talk to a lawyer and recover your cash.

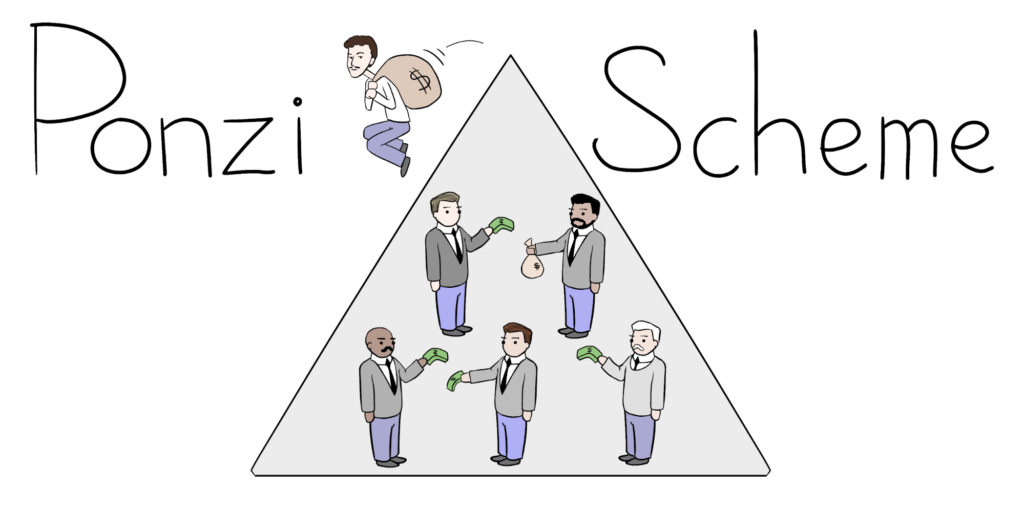

Ponzi Schemes

When someone solicits money from another individual and uses another investment to pay them, they are guilty of running a Ponzi scheme because there is no actual investment.

Surely, we are talking about one of the commonest scams we’ve faced recently. Many people lost millions of money through this scam.

Churning

Brokers make a commission from every investment they make. This fraud happens when a broker makes a ridiculous amount of trade to increase their commission. If a certain broker uses your money for its own advantage, and to your damage, you can hold that person accountable and sue it.

In Conclusion

As we can see, there are a lot of different scams and frauds in this world of ours. So many people have lost a fortune as a result of these. To avoid losing money in these processes, you will need to be educated on what sorts there are. Here, you can take a look at some of the commonest ones.