Most of our opinion proved wrong by the financial institutions as we were expecting something else, but the institutions were in the opposite direction to the world economy. Wallester, an Estonian company, is issuing labelled debit cards of high-tech nature and the integration of REST API is of great help to both physical and virtual cards. The white label debit program of the company can help you in a faster way, and it is integrated with almost all types of cards. The integration feature is better than all other cards in the market and will assist you anywhere across Europe. For more details, you can visit our website.

The competition is tough, and most companies are working on their loyalty programs; customers are issued cards with the logo and other brand specifications. Companies thus offer different cards with various features, including debit, credit, virtual and prepaid cards. Some cards have certain issues that make it difficult for customers to bring them to use when needed. Wallester, on the other hand, provides cards with well-tailored and modified API, which is designed by an expert team. Their cards are easy to use as payment functions are made easy and well unified. Using their cards make transactions simpler and without any delay.

The company has made its card processing system very user-friendly, and there is nothing difficult in it. All the simple features are due to the use of advanced technology and API, and it can be easily integrated with all platforms without any difficulty. “Our platform includes modest technologies, which makes us flexible and even implement any of the client’s new ideas, motivating us to develop them for anyone’s use and make us grow constantly, up with the time,” says Dmitri Logvinenko, Member of the Management Board and CTO of Wallester AS. Being Visa Partner and Visa FinTech Fast Track member, Wallester officially issues debit cards, credit cards, prepaid cards, business cards, and white label debit cards without taking much time. Customers can get their cards, and it takes no time to launch a debit card program and white label debit card system.

Thanks to the white label debit card solution, customers can get the desired branded debit card. The card will have the company’s logo and mobile application, giving their product an extra edge among others in the market. The advanced CRM platform can make the card more user-friendly and easy to use. The market is full of competition. The Wallester card is of great value. The virtual and physical cards will have the customer’s logo and brand recognition on the top, making the product more unique and recognizable. The cards with attractive logos and a customized design increase brand awareness and customer loyalty and enhance the company’s customers base. In this way, the product gets extra marketing and a customer base for the company.

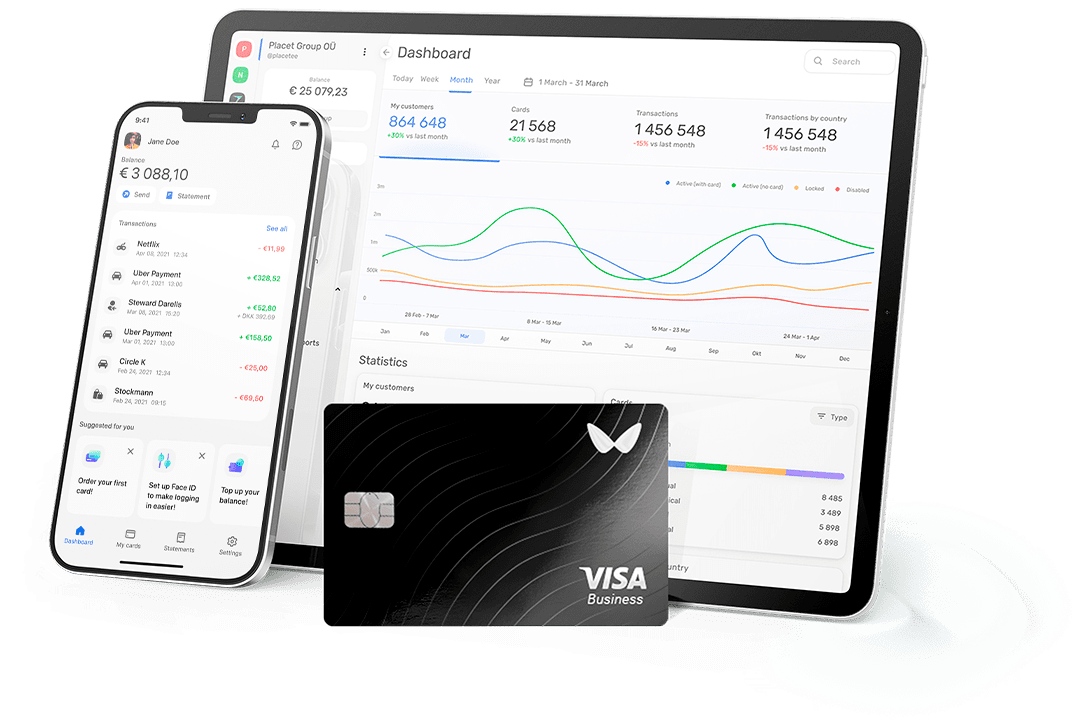

Wallester’s mobile application is a great tool for all the information related to customers. With the application, anyone can get quick access to all the information, transaction history, payment detail, and other information that might be needed. Besides the mobile application, there is a separate official portal for customers where information for cardholders is available about processing, analysis, and unwanted circumstances, i.e. fraud and errors or misleading information, to avoid any risk. Many unknown facts are there, and innovation in the financial industry, including FinTech setups, loan agencies, banking sector, travel agencies, insurance companies, is unknown. Still, Wallester has made it sure in their cards looking at the prospects.

Benefits of white label debit card

A white debit card gives the company multiple benefits, among which are the followings

1) Easy set up

With white labelling, you can use the label for the product that is developed by another country that will make your work easy you don’t have to think about the different ways to bring your product into the marketing already someone is doing for you, so it is highly beneficial for the companies to use white label even you don’t have to look for any strategies only placing your brand logo on the product can make your work done

3) Additional revenue stream

While looking at how much the fees are connected to the cards, introducing prepaid cards can create multiple revenue streams for your highly profitable company. Let me explain to you. You might get a portion of the sale every time someone uses their card to pay for any product. Not only that, you might get the fee charged when a user withdraws cash at an ATM. Yes, that’s mind-blowing ost companies are using this method to make it more and more profit

4) Customizable

You can exchange your prepaid cards with your brand’s logo and any colour scheme you prefer moreover. the one more facilities are that You can also decide who gets to use the cards, such as your employees, contractors, customers, or students, so that’s how you can allow them to use for the specific person

4) Increases customer loyalty

You must consider how Prepaid cards can increase people’s loyalty to your brand? Well, Suppose you introduced a prepaid card that offers rewards, like points or cashback. In that case, people are more likely to use it for purchases as it demands many customers. Customers, contractors, or employees might be more likely to choose the prepaid card option for payments rather than a check or direct deposit. Since it also gives profit to them so who won’t want to miss such an opportunity.

5) Payroll

Mostly everyone is busy nowadays so Prepaid cards can fast the payroll process, which can save your company time and money especially if you have a large workforce then its really for you nowadays very person wants work to be quick and to be secure so with Connecting prepaid cards to people’s earnings can automate the payment process. It also saves money as you don’t have to pay for paper checks and all that which waste your money.

6) Easy of use and safe

You don’t have to wait for the complex method of payment, or use cards that are very easy to use .you can effortlessly withdraw the fund. It also enables cardholders to spend money, and unlike others, it also ensures safety. It is linked with the amount of money you loaded, so if you make a high purchase with low debt, it will be declined.