Managing finances for your personal needs certain principles. It may appear to be a complex subject, but spending within your means is key. Saving and investing is an art. It is also about accountability.

If you haven’t learned about finances in school, it is your responsibility to learn about these topics which affect your day-to-day life. It is essential to understand financial issues like budgeting, banking, insurance, mortgages, investments, retirement planning, and tax and estate planning.

Numerous financial service providers advise individuals about financial and investment opportunities. If you like to learn more about financial topics, you must start reading financial news. You can follow financial news on FastBull.com to get more insights into several economics-related subjects.

Personal finance is ultimately about meeting your financial goals, whether for retirement plans or merely saving for your child’s education, as confirmed by Debt Busters. Everything depends on your income and expenses, personal financial goals, and desires. It would help if you were financially literate to make intelligent decisions to fulfill your requirements. It would help if you came up with a plan to distinguish between good and bad advice within your financial ability.

In this article, we look at five financial topics you need to understand when handling personal finances.

1. Budget

Your budget is the first question when you want to purchase any commodity or undertake a project. For instance, when you plan to go on a trip, you need to know the budget. Budgeting is about creating a plan on how to spend money. It is about being financially innovative and developing strategies that include creating an emergency fund, paying off debt, using credit cards wisely, saving for retirement, etc.

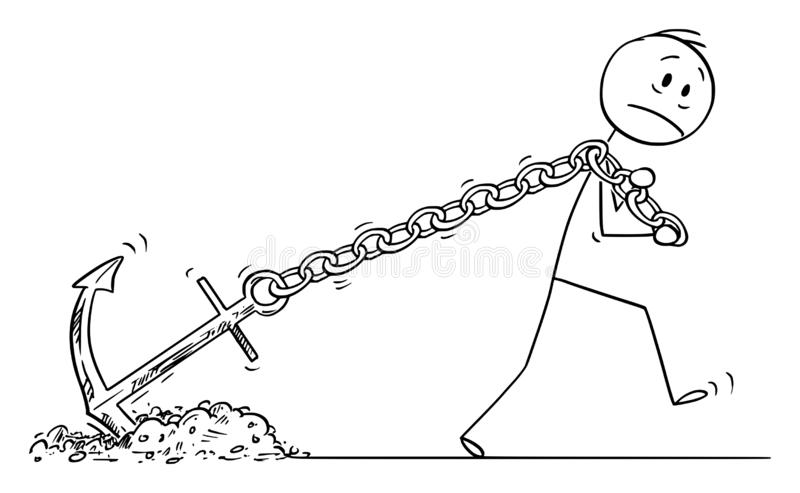

Budgeting or having a spending plan helps you to determine in advance whether you will have enough money to do the things you need to do or would like to do. It also balances your income and expenditure instead of sinking into debt. Once you draw up a budget, you need discipline regarding financial spending and working your way out of debt.

There is no one way to plan your budget. There are several different budgeting methods. One of the most popular is allocating the 50/30/20 percentage budgeting system for housing, shopping, and savings. Many budgeting apps on the market, such as You Need a Budget, help you plan your spending and track your expenses throughout the month.

2. Debt

Limiting your debt prevalent in society is essential for managing personal finances. For that, you have to understand each debt you have fully. There are different types of debt. The most common is revolving debt when you use a credit card or get an overdraft.

Non-revolving debt is when you borrow a lump sum and settle it periodically, such as mortgages, personal or car loans. Then there is a secured debt, where using assets as collateral, the lender can seize your home or car when you don’t repay.

Unsecured debts are personal loans and credit cards where the lender can only take legal action to recover their money. It is best to keep debt from getting out of hand by not spending more than you earn. Leasing may be more economical than buying a car outright but borrowing within your means is the key.

3. Saving

You hear the word saving from the day we started handling finances. Even if you have an income or have a budget to spend, saving is one of the most critical components of personal finance. Save for a rainy day is the most helpful advice anyone would give you.

Savings is not out of necessity but becomes a priority in any emergency. You need to have a fund to cover unforeseen expenses, especially when you lose your job or fall sick. The other type of saving is to achieve specific goals such as a dream vacation or down payment on a home.

There is no magic formula to save money. You have to do it. You can do it by simply paying yourself a certain sum monthly as savings, to begin with, instead of spending every penny of your income.

4. Investing

Investing does not necessarily mean buying shares and trading in the stock. This sort of investment can be intimidating to the ordinary person. Investing in a retirement plan or life insurance scheme would be better for the average earner. It is about setting aside your income to spend in retirement, which may arrive much sooner than you would expect.

Some benefit from a pension fund, but most people need about 80 percent of their current salary in retirement. The sooner you start to invest, the greater the returns. Financing is only one part of planning for old age.

It grows at a much faster rate so that eventually, your investment compounds enough so that you can retire. A few tips before starting to invest are to consider how you divide your assets, the number of years, and your ability to take risks.

5. Credit

Credit cards are like a double-edged sword. It can be a significant debt trap unless you manage its correctly. You have different kinds of it, for example management buy out structure can be helpful with solving this matter. Understanding the management buy out structure can be a daunting process as you need to explore several critical areas before investing. This guide by Price Bailey will help you navigate through it successfully so read on to know more.

It is better to pay off your entire balance every month to maintain your credit rating. That is keeping your credit utilization ratio below 30 percent of your total available credit.

There are many rewards, such as cashback, but it makes sense to repay your purchases in full. You should avoid late payments using credit cards to the maximum at any cost. If you don’t pay bills on time, you can ruin your credit score. It is best to use a debit card whenever possible because you pay directly from your bank account.

Your credit score will also go up with your sensible use of credit cards. Your spending goes hand in hand with monitoring your credit score. It will be critical to obtaining a lease, mortgage, or other financing types.