It has occurred to all of us many times that we should invest in something, not just count on our salary, and later on a pension, and live for the rest of our lives without earning the bigger amount of money. Investing money in the stock market is certainly very tempting, but everyone usually thinks that it is reserved only for people who have huge sums of money. Although many types of investments, such as day trading, require more start-up capital, there are ways to save and invest very small amounts.

This primarily applies to micro-investing platforms that allow you to save literally minimal amounts of a few dollars and start investing in the stock market. Isn’t that great? To fulfill the American dream and reach millions from scratch. In order to be successful in this endeavor, it is necessary to choose the best possible micro-investing platform. And that can be very complicated because there are a lot of them and they are all seemingly similar. But the differences are actually big. So we will give you tips for choosing the best micro-investing platform and make a comparison of the three best in our opinion.

What is micro-investing?

This is a new way of investing and that is why many have never heard of it. What is a big advantage is that you can start with this today. You don’t need any preparation in terms of new saving habits or borrowing money to get started. Any spare money you have left, the platform you choose will automatically invest in the stock market, even though you have no knowledge of it. As you can conclude, this is the best start to investing, both because you risk a little money and because you don’t have to have knowledge. Maintenance fees are much lower than in other types of investments, so everything is intended for beginners.

Tips for choosing

1. Research

Although these are small sums and you do not risk much, it does not mean that you should take all this lightly, but you should definitely do detailed research. Research should consist of looking for a platform that is closest to your goals. First, you need to set goals and get informed about all this so that you can do research. Otherwise, you will search blindly. Your goals have to be realistic and you should learn the basics of micro-investing in order to be able to notice potential fraud and avoid that platform.

2. Check the reputation

Reputation in this business is everything. While in some other jobs a few bad reviews may be tolerated, here only choose the one where everything is perfect. Check the recommendations on the site, but independent reviews are much more valid because you will find everything positive on the site. Also, there are a lot of sites where you can read deep insight, so visit such websites as well. You should check legal documents also. Don’t forget you are investing money here. People tend to be reckless because small amounts of money are being invested, but what if you earn big and then problems arise? Do your homework and then you can wait for things to develop.

3. No minimum investment requirements

The point of the whole micro-trading is to invest very small sums. That is why you need to find a platform that has no minimum investment requirements. We are talking about such small amounts as a few dollars and most platforms allow you to start with so much money. So if there is a minimum investment requirement somewhere, it is not a good choice. In micro-trading, the point is that if you take a smaller burger than usual, you can already become an investor with those few dollars difference. You got the point why there should be no minimum investment requirements.

4. Compare

Once you have narrowed down your choice to several platforms, then it’s time to compare them. There is no one that is best, you just need to see which one suits you best. Also check the relationship between risk and potential earnings, because there is no point in going into something where you are likely to lose money, and the chances of winning are only theoretical. If you choose such an investment, then the potential gain should be very large.

Robinhood vs Acorns vs Stash comparison

We narrowed down our search to three platforms for you and we will give you a brief info about each one of those three.

Acorns

Acorns is a very good platform, which allows you to personalize everything. The first thing you need to determine is whether the platform will automatically round up all purchases or you will do it manually. Usually, everyone decides to do round up automatically, because that is the point of micro-investing. When you turn this option on, it often happens that you forget to use the platform at all. And then all of a sudden you’re pleasantly surprised to see that you have a few hundred dollars in your account after a couple of months. Fee is one dollar per month. The interesting thing about Acorns is that the name is designed to be associated with squirrels, which stores food for the winter.

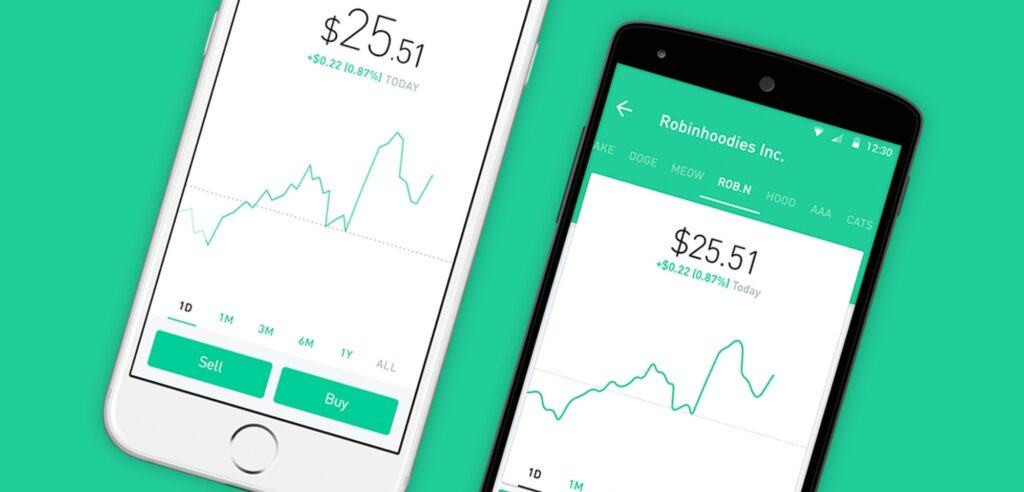

Robinhood

No, don’t think that this platform steals from the rich and gives to the poor. The name should be associated with the fact that anyone can be an investor, no matter how little money they have. There is no minimum so you can start with just a few dollars. You can trade stocks and many other things that are otherwise available for micro-investing. Of course, you can’t trade bonds and other things from the big league. If you have a portfolio of more than $ 2,000, margin training will also be available. According to Loved.com, Robinhood is an option that is more intended for the experienced compared to Stash and Acorns. The fee is five dollars a month.

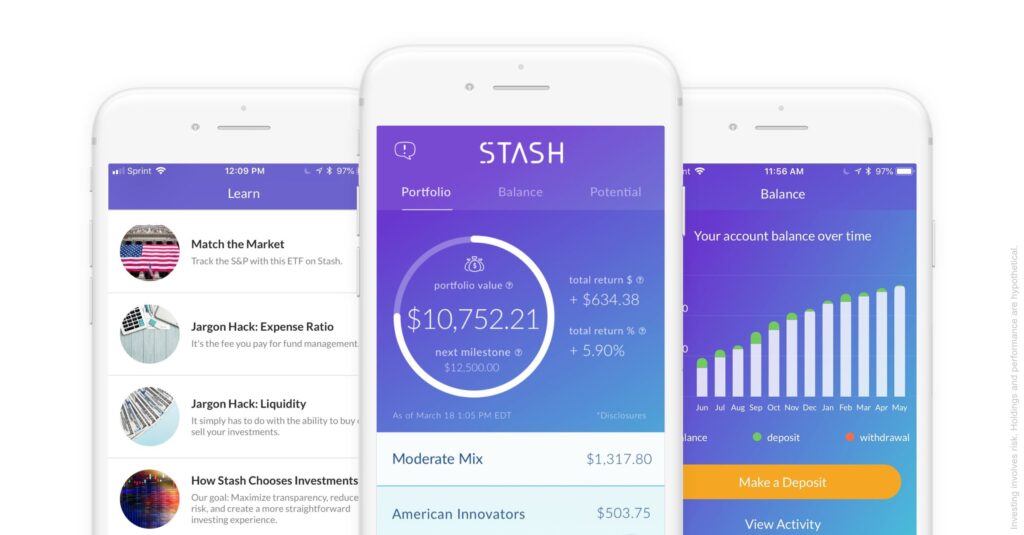

Stash

Stash is a very simple app, ideal for beginners. It was created in such a way that even a complete layman when it comes to the stock market can cope. Everything is sorted by categories and it will be easy for you to find exactly the stocks you want. They will also ask you at the beginning what kind of approach you want to be, and you can choose between conservative, moderate or aggressive. The fee varies, so you choose what kind of service you want. The cheapest fee is just one dollar.

Conclusion

Of course, not everyone can be Warren Buffett. But just because you’re not a stock market expert and you don’t have billions at your disposal, doesn’t mean you can’t start trading with small amounts of money. And who knows, in time you might earn quite a bit. If you’re interested in getting started, then micro-investing is an ideal option to get started.